We receive and publish the following insights from the Ushare blog team and the CEO of DTSocialize on Consob, highly useful for those acting as brokers and investigating risks associated with Bitcoin exchanges. Consob has recently organized a seminar on digital finance and how cryptocurrencies are impacting investments in Italy. The meeting revealed very interesting insights and outlined the “profile” of cryptocurrency investors.

Profile of retail crypto investors

Male, young, overly self-assured, and a lover of the digital nature of financial markets. This is the profile of retail crypto investors developed during the seminar on digital finance and the world where cryptocurrencies affect investments.

In fact, according to recent statistics, 84% of people interested in cryptocurrencies are male, and of these, 74% show less aversion to risk. 34%, in fact, do not express concern about potential losses. This personality can be attributed to the fact that, in most cases, these are young investors who often do not yet have the need to manage family responsibilities, which is why they tend to act more boldly.

Watch out for overconfidence

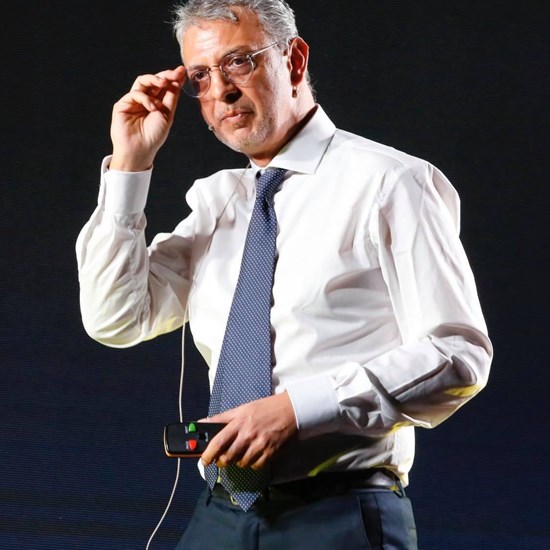

It must be emphasized, however, as Daniele Marinelli (DTSocialize holding) continued, that from the extrapolated results, 35% of investors exhibit overconfidence in their abilities, considered excessive. Essentially, there is a perception of overestimated financial knowledge. In fact, according to the data, cryptocurrency investors have poor financial knowledge globally (31% compared to 53% of those not interested) and also in terms of digital security (40% compared to 52% of those not interested). Normally, also, only 19% of these investors tend to use financial advisory services, unlike the 43% who show no interest. 36% of cryptocurrency investors tend to save regularly, a slightly lower rate than the 44% who are not interested in this type of investment.

Trader’s profile

In addition to the profile of cryptocurrency investors, Consob has analyzed the profile of individuals interested in online trading. Traders are much more informed about all financial products and digital security. 81% of respondents have shown a rather high level of familiarity with digital finance, but they are less inclined to do-it-yourself finance and more prone to financial advice (32% compared to 39% of those not interested). Finally, 40% of respondents adopt regular savings, proving to be “less diligent” compared to the 44% who are not involved in online trading.